-

Section 01

Overview

-

Section 02

Ngā hononga, me ngā tūranga, me ngā haepapa Relationships, roles and responsibilities

-

Section 03

Te kopou me te tuarā i tētahi poari hurikiko Appointing and maintaining an effective board

-

Section 04

Te whāi wāhi atu ki te whakatakoto i ngā kawatau me te ara whakamua mō ngā hinonga Participating in setting the expectations and direction for entities

-

Section 05

Ka pēhea tā tō tari aroturuki āwhina i a koe? How can your monitoring department assist you?

-

Section 06

Appendices

Āpiti 1 – Te wāhi ki ngā hinonga Karauna i roto i te rāngai tūmatanui Appendix 1 – How Crown entities fit into the Public Service

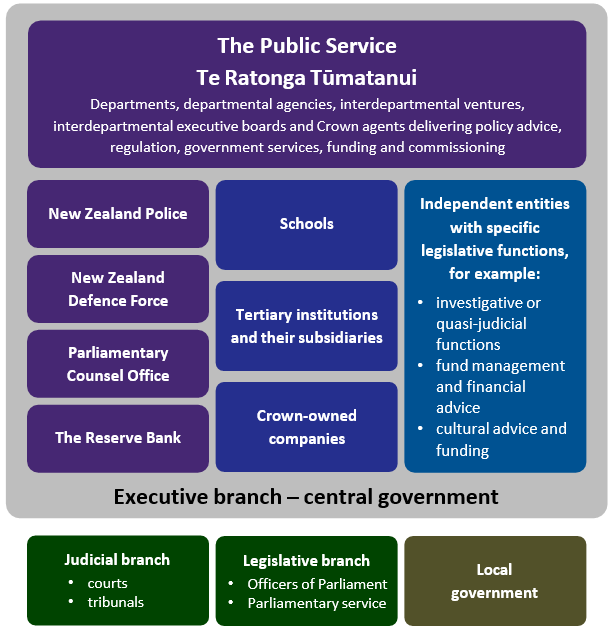

A. Public sector composition

B. Public sector glossary

| Key to terms used in public sector map (these are descriptions not legal definitions) | |

| Agency | Synonym for ʻorganisationʼ. A blanket term that may include departments, Crown entities, State-owned Enterprises, PFA Schedule 4 organisations, PFA Schedule 4A and 5 companies, Offices of Parliament and the Reserve Bank. |

| Autonomous Crown entity | Autonomous Crown entities (ACEs) are statutory Crown entities that must have regard to Government policy directions, as distinct from giving effect to Government policy directions or being generally independent of Government policy. |

| Crown | Means the Sovereign and includes all ministers of the Crown and all departments (including any of their departmental agencies). It does not include any other type of ʻorganisationʼ described in the definition of ʻagencyʼ above. |

| Crown agent | Crown agents are statutory Crown entities that must give effect to Government policy directions, as distinct from having regard to Government policy directions or being generally independent of Government policy. Crown agents are those Crown entities most closely subject to ministerial control. They are also included in the legal definition of the Public Service for the purposes of shared principles, values, spirit of service and standards of integrity and conduct in Part 1 (subparts two and four) of the Public Service Act 2020. |

| Crown entity |

Crown entities are stand-alone corporate bodies that are legally separate from the Crown. They are public bodies that operate at armʼs-length from ministers, but still an integral part of the public sector. Ministers have a key role in managing the Crownʼs interests in Crown entities, for example through their role in board appointments, setting direction and funding levels, and monitoring entity performance. Section 7 of the CEA 2004 outlines the five categories of Crown entity: • Statutory entities – bodies corporate established through legislation; |

| Department |

The departments that comprise the Public Service are listed in the Second Schedule to the Public Service Act. In addition to those departments, the Public Finance Act includes the New Zealand Defence Force, New Zealand Police, Office of the Clerk, Parliamentary Counsel Office, Parliamentary Service and the New Zealand Security Intelligence Service in the definition of department [Section 2]. The latter departments are also referred to as ʻNon-Public Service Act departmentsʼ or ʻNon-Public Service departmentsʼ. |

| Departmental agency | Legally part of the host department and listed in Part 1 of Schedule 2 of the Public Service Act, departmental agency chief executives report directly to the minister responsible for the Departmental Agency, who may or may not be the same as the minister responsible for the host department. |

| Independent Crown entity | Independent Crown entities (ICEs) are statutory Crown entities that are generally independent of Government policy, as distinct from giving effect or having regard to Government policy. |

| Interdepartmental executive board | An interdepartmental executive board provides collective strategic policy advice to ministers for cross-agency issues. Their purpose is to align and co-ordinate strategic policy, planning, and budgeting activities for 2 or more departments with responsibilities in a subject matter area |

| Interdepartmental venture |

Interdepartmental ventures bring together the delivery of services from across a small number of agencies. Their purpose is to deliver services or carry out regulatory functions that relate to the responsibilities of 2 or more departments; and to assist to develop and implement |

| Mixed Ownership Model companies |

Mixed Ownership Model (MOM) companies are listed in Schedule 5 of the Public Finance Act 1989. This model applies to companies, majority controlled by the Crown, and minority controlled by persons other than the Crown. |

| Offices of Parliament |

The primary function of an Office of Parliament is to be a check on the Executive, as part of Parliamentʼs constitutional role of ensuring accountability of the Executive. An Office of Parliament must discharge functions which the House itself might appropriately undertake. Currently there are three Offices of Parliament: Office of the Controller and Auditor-General, Parliamentary Commissioner for the Environment, and Office of the Ombudsmen. |

| Public sector |

The public sector refers to the Public Service and all other government agencies, including those which support all three branches of central government (executive, judicial or legislative) as well as local government. |

| Public Service | Public Service Te Ratonga Tūmatanui refers to public service departments and departmental agencies. It also includes Crown agents (those Crown entities which have the closest relationship with ministers and deliver many important public services) for some purposes. The term Public Service also includes two types of entities introduced in the Public Service Act 2020: interdepartmental ventures and interdepartmental executive boards. |

| Public service principles |

The public service principles are: Free and frank advice – when giving advice to ministers, to do so in a free and frank manner; and Merit-based appointments – to make merit-based appointments (unless an exception applies under this Act); and Open government – to foster a culture of open government; and Stewardship – to proactively promote stewardship of the public service, including of (i) its long-term capability and its people; and |

| Public service values |

The public service values are: Impartial - to treat all people fairly, without personal favour or bias Accountable - to take responsibility and answer for its work, actions, and decisions Trustworthy - to act with integrity and be open and transparent Respectful - to treat all people with dignity and compassion and act with humility Responsive - to understand and meet peopleʼs needs and aspirations. |

| Responsible minister | The minister accountable to Parliament for the financial performance of a department or Crown entity. In relation to an Office of Parliament, the Speaker is the responsible minister. |

| Public Finance Act Schedule 4 organisations | PFA Schedule 4 has a list of miscellaneous organisations, including Fish and Game Councils and Reserve Boards, which are subject to certain provisions of the CEA (specified in the Schedule). |

| Public Finance Act Schedule 4 companies | Schedule 4A of the Public Finance Act has a list of companies in which the Crown is the majority or sole shareholder, and which are not listed on a registered market. Public Finance Act schedule 4A companies are treated as Crown entities for the purposes of directions under the section 107 of the CEA 2004, and various sections of that Act relating to financial powers also apply (as specified in the Schedule). |

| State-owned enterprise (SOE) | SOEs are businesses (typically companies) listed in the First Schedule to the State-Owned Enterprises Act 1986. SOEs operate as a commercial business but are owned by the State. They have boards of directors, appointed by shareholding ministers to take full responsibility for running the business. |

| State services |

A term defined in section 5 of the Public Service Act 2020.

|

Āpiti 2 – Ngā pārongo mā ngā hinonga Karauna e haere ana hei kamupene Appendix 2 – Information for Crown entity companies

The CEA applies to the ʻCrown entity companiesʼ category in much the same way as it does for statutory entities. However, Crown entity companies are subject to the Companies Act as well as the CEA and a number of the governance provisions of the CEA are designed for statutory entities and do not apply to Crown entity companies. As a result, there are some specific differences.

Differences in governance

Whereas statutory entities have ʻresponsible ministersʼ, Crown entity companies have ʻshareholding ministersʼ, the ministers who hold shares in a Crown entity company. One of these must be the Minister of Finance.

The process for removing board members of Crown entity companies is slightly different from that for statutory entities. Shareholding ministers may remove members by shareholder resolution under the Companies Act 1993 (see s. 88(1)(a)). Under the Companies Act 1993, an alternative process (for example, removal by notice in writing) may be followed if allowed by the companyʼs constitution.

Ministers do not have the power to direct Crown entity companies on matters of policy unless specifically provided in another Act (s 105). However, Crown entity companies may be subject to directions to support a whole of government approach. A Crown entity company must comply with any direction given to it under a power of direction in another Act, and any whole of government direction given to it under s. 107 of the CEA, except that Crown Research institutes (CRIs) are only required to ʻhave regard toʼ, not ʻgive effect toʼ, s. 107 directions.

Setting and monitoring strategic direction

Shareholding ministers of Crown entity companies have an important role participating in setting and monitoring the strategic direction of Crown entity companies (s. 88). To assist in this role, ministers may require Crown entity companies to supply a range of information (s. 133) subject to certain limitations (s. 134).

The Treasury has a monitoring role on behalf of the shareholding ministers in relation to Crown entities. The Treasury:

- monitors the governmentʼs investment in many Crown entity companies

- assists with the appointment of directors to boards, and

- provides performance and governance advice to shareholding ministers.

In exercising the Crown entity companyʼs powers the board owes a collective duty to its shareholding ministers to make sure that the company:

- acts in a manner consistent with its objectives functions, SPE and SOI, and

- complies with its duties to its subsidiaries.

Different constraints

The CEA contains specific constraints on the exercise of Crown entity companiesʼ powers. There may be other constraints in the Companies Act or other Acts that are also relevant. The constraints in the CEA include:

- conditions on acquiring subsidiaries, interests in joint ventures etc

- conditions on bank accounts

- conditions on the exercise of various financial powers, unless an exemption is granted in the Act, and

- a requirement to consult with the Public Service Commissioner before agreeing to the terms and conditions of collective employment agreements, if an Order in Council has been made to that effect.

Exceptions for Crown Research Institutes

CRIs, as Crown entity companies, are subject to the CEA with several notable exceptions. For example:

- the duties of the board and board members in 92–95 of the CEA do not apply to CRIs

- the rules applying to the operation of Crown entity subsidiaries in 97 do not apply to CRIs

- CRIs are required to ʻhave regard toʼ, not ʻgive effect toʼ, 107 directions to apply a whole of government approach, and

- a number of the reporting provisions do not apply to CRIs.

These exceptions reflect that CRIs also have governance and accountability requirements as set out in the Companies Act and the Crown Research Institutes Act 1992. They also reflect that CRIs have been encouraged to take a greater role in commercialising their own research through the establishment of subsidiaries and joint ventures.

Note on Public Finance Act Schedule 4A companies

Schedule 4A of the Public Finance Act has a list of companies in which the Crown is the majority or sole shareholder, and which are not listed on a registered market. PFA schedule 4A companies are treated as Crown entities for the purposes of directions under the section 107 of the CEA 2004, and various sections of that Act relating to financial powers also apply (as specified in Schedule 4A).